home | north bay bohemian index | features | north bay | feature story

Blowing Hot Air

The largest green energy field in the United States is actually run by old-school oil interests. Who's behind the steam at The Geysers?

By P. Joseph Potocki

Millions of gallons of North Bay wastewater are pumped high into the Mayacamas Mountains each day, injected down deep-drilled wells aimed at permeable igneous rocks, which lie like enormous frying pans atop molten magma thousands of feet beneath the earth's crust.

On contacting this supraheated rock, the water flashes into steam, racing back to the surface via corresponding production wells. The steam is funneled through tentacle-like networks of above-ground pipes before arriving at one of 22 spotless geothermal plants spread throughout 30 square rugged miles comprising The Geysers geothermal area. The steam is fed through turbines mounted inside each plant, which generate more electricity than any other geothermal field in the entire world. In fact, the electricity generated from these plants could easily power the entire North Bay, were it a truly local resource.

My idea was that there might be some big company who was trying to control all the hot lands, and as I consider the Geysers the best . . . therefore could not see how it was to your advantage to join any such combination when you have done all the pioneer work and put the whole matter on a good foundation.

—Luther Burbank's 1924 letter to Mr. J. D. Grant of Healdsburg

Eighty-four years have passed since Luther Burbank penned that letter. The Geysers, the geothermal power anomaly Burbank hoped would remain in local hands, is instead a tiny subholding tied to trillions of international finance dollars, massive worldwide pollution, carbon energy, corporate rip-offs, juicy scandals, Third World oppression, neo-con and Republican Party politics, and even to the machinery of war.

But what does this transcontinental dynamic suggest about the nascent development of our nation's renewable "green" energy resources? Will humanity's inevitable shift away from "dirty" fossil fuels merely lead to an adjusted energy regime, a corporate-controlled continuum emphasizing nuclear, ethanol, geothermal, massive solar plantations, mammoth wind farms and other big centralized "clean" technologies?

Or does our ongoing energy crisis bring us to an opportunistic fork in the road, a point at which we might choose to shift the entire energy paradigm and plunge, Manhattan Project–like, into developing technologies aimed at decentralizing energy generation, taking us off the grid for good by clean-powering our entire physical existence from those very places we live, work and play?

One way to explore these complex issues is to put a face—or in this case, three distinct human faces—upon the corporate power structures within which our local green resource, The Geysers, is currently subsumed. In other words, let's start by exploring just who's really behind all that steam at The Geysers.

The New 'Deal'

"Delaney & Strong can make a lot of money with your tax plan," star investment banker Tom Hanson says to naive environmentalist Abbey Gallagher, concerning her carbon-trade-for-pay scheme. "Which means all these companies that are developing alternative energy will finally get the money they desperately need. At the end of the day, it's all about results. All the good intentions in the world," Hanson says, "aren't going to save the planet."

—From the movie The Deal

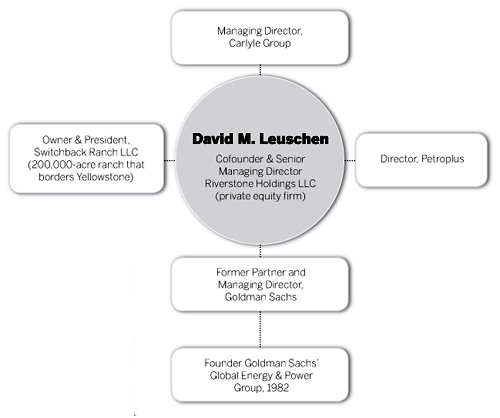

David M. Leuschen was an executive producer (i.e., the money man) for Christian Slater's 2005 straight-to-DVD flop The Deal. The film has all the earmarks of an autobiopic wank-fantasy. In real life, Leuschen is cofounder and senior managing director of the private equity firm Riverstone Holdings LLC. He's also a managing director for the Carlyle Group. Carlyle Group associates, past and present, include former president George H. W. Bush, his former secretary of state and consiglieri James Baker, former U.K. prime minister John Major, billionaire George Soros, former secretary of defense Frank Carlucci and Shafig bin Laden, brother of you-know-who.

Riverstone and Carlyle partnered up with U.S. Renewables to buy up both Santa Rosa–based ThermaSource, which provides worldwide geothermal drilling services, and the newly restored Bottle Rock geothermal plant located at The Geysers in Lake County.

For relaxation, David Leuschen kicks back at his Switchback Ranch, 200,000 acres abutting Yellowstone National Park in Wyoming. But don't think this means Leuschen's some soft-headed enviro-nut. Nosiree, he's a former partner at what the NPR show Marketplace calls "the granddaddy of investment banking," Goldman Sachs.

Leuschen founded and later headed up Goldman Sachs' Global Energy and Power Group, advised Mobil on its merger with Exxon and, according to the Carlyle Group, "was responsible for establishing and managing the firm's relationships with senior executives from leading companies in all segments of the energy and power industry." These companies, in addition to Exxon-Mobil, include Kuwait Petroleum, Chevron, BP Amoco, Unocal, Anadarko Petroleum, Kinder Morgan, and Phillips, to name but a few.

While Leuschen may dabble in geothermal, solar and ethanol, he's stuffed to the gills with fossil-fuel investments, including lots of dirty coal-fired plants. "Our first obligation to our investors is to make money," Leuschen told BusinessWeek in 2006, "and I wouldn't have initially considered renewable energy the best place to make money." In other words, damn the environment, full carbon ahead!

And now, back to Hollywood.

Mideast war rages across an obsolete cathode ray tube. U.S. homelanders take it in the shorts as gas hits six bucks a gallon. It's us true-blue, freedom-lovin' patriots against them schmarmy A-rabs again, and we're jonesin' bad to score their cheap sweet crude. Condor Oil, the high-powered energy firm with ties to the White House, steps in with the fix: a dubious-sourced petrol flood from Kazakhstan.

Meanwhile, star investment banker Tom Hanson (Christian Slater channeling David Leuschen?) from Delaney & Strong (read: Goldman Sachs), "the most prestigious firm on Wall Street," seduces cute kung-fu tree-hugger Abbey Gallagher (Selma Blair) over to the corporate dark side, from whence, Hanson reminds us, all sensible environmental protections and alternative green-energy breakthroughs are conceived, designed and implemented.

By the film's end, our shining knight has throttled the Russian mafia, resurrected his embattled firm, exposed corporate malfeasance, nailed the girl, saved the nation's honor and mused over how he got here from art school—before dramatic irony knocks him from his idealistic perch, thus restoring the rational cynic in him. Anyway, that's The Deal.

Ring of Fire

The David M. Leuschen–invested Geysers are actually fumaroles, meaning the hot fumes they emit are mostly dry steam. The Geysers are tied into both the volcanic and seismic systems of the Pacific Ring of Fire. Volcanics provide the thermal, supraheating permeable rock beneath the earth's crust, while the millions of gallons of treated wastewater shot down The Geysers' injection wells periodically provoke earthquakes.

For at least 10 millennia, aboriginal peoples came here for medicinal and spiritual R&R. During the American Era, these 30 square miles of billowing hot plumes, mud pots and "radium and arsenic" hot springs were used for a series of commercial resort ventures. Mark Twain, J. P. Morgan, Ulysses S. Grant, P. T. Barnum, the future King Edward VII, William Jennings Bryan, Teddy Roosevelt and Italian revolutionary Giuseppe Garibaldi were a few of its many famous visitors.

In 1921, gravel-pit owner and Healdsburg native J. D. Grant realized that The Geysers could be harnessed to generate electricity for local communities. Famed horticulturist Luther Burbank ponied up as an investor. But Grant's initial stab at tapping The Geysers' electricity-producing potential proved a financial failure. Truth is, he just couldn't compete with cheap fossil-fuel operations.

Two other local firms gave it a shot in the 1950s, but it took power behemoth PG&E to build the first "modern" geothermal electricity plant at The Geysers in 1960. Union Oil Company of California assumed operation of the steam fields in 1967. Sixteen years later, Union Oil morphed into a subsidiary of the newly formed Unocal, which eventually was acquired by Chevron.

The Geysers are only arguably a renewable "green" resource, though. Arguably renewable, because just like any sauna, keeping the rocks hot presents a challenge. Experts predict The Geysers' heat will peter out in decades to come, even with judicious management of the resource.

Secondly, The Geysers are only arguably green, because while they emit far fewer toxins than oil or coal-fired facilities, they do spew steam that contains arsenic, chromium and copper. On the other hand, PG&E estimates a 1 million–barrel oil savings for each 110 megawatts of power generated each year at The Geysers. With its current 750 megawatt output, that means The Geysers save the environment 7 million expended barrels of oil each year.

However, even combined with every other geothermal resource worldwide, geothermal presently delivers merely a drop in the terrestrial energy bucket, especially when compared to the open hydrants of fossil fuels pouring into today's marketplace.

Some 22 separate power plants spread throughout The Geysers draw from nearly 400 production steam wells powering turbines generating sufficient electricity to keep the entire North Bay humming 24/7. While additional power plants are currently in the works, 19 of the 22 facilities presently online at The Geysers are owned and operated by Calpine Corp. However, Calpine, which recently emerged from Chapter 11 bankruptcy, is considered prime pluckin's. Just this May, Calpine fended off a hostile takeover bid from rival indie producer, New Jersey–based NRG, who, it is said, along with others, still has Calpine in its crosshairs.

The Fix-It Guy

I'm Winston Wolfe. I solve problems.

—Pulp Fiction

Problems, indeed. In Quentin Tarrantino's famed edit-fest, underworld fix-it man Winston Wolfe, brilliantly portrayed by Harvey Keitel, directs cinema's seminal no-bullshit, bust-a-gut, murder-scene scrub-a-dub. Once the crime's bloody evidence has been hosed down and disposed of, so too away rides Wolfe like some lonesome celluloid cowboy riding off into the sunset—only this cowboy's lonesomeness is attenuated by a trophy moll in tow.

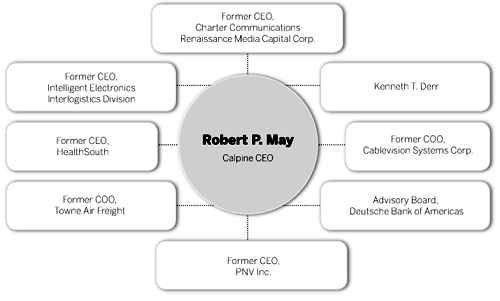

Which leads us next to Geyser-capo number two, corporate turnaround specialist and soon-to-be ex–Calpine CEO Robert P. May. May is the cucumber-cool corporate version of Winston Wolfe. And just like Mr. Wolfe, who cleans up the scene and moves on, Robert May will soon depart Calpine, doubtless to clean up yet another corporate mess somewhere not far over that angry investor-strewn horizon.

The past four years have been busy ones for May. He bailed out Richard Scrushy's $2.7 billion accounting-fraud-wracked HealthSouth Corp. after five consecutive CFO's pleaded guilty of involvement. May also resuscitated Microsoft billionaire Paul Allen's Charter Communications before coming on board to shepherd Calpine through its Chapter 11 bankruptcy.

Aside from the Calpine mess, the Charter sitch seemed a particularly sticky wicket. May walked in following the indictment of four Charter Com execs, after the Better Business Bureau gave Charter two thumbs down and after both Consumer Reports and PC World suggested that Charter's media services ratings lay beneath the industry's metaphorical barrel bottom. All of this just months after Charter had pried open its coffers to settle a class action lawsuit dealing with shady financial reporting.

Still, Calpine couldn't have been much of a cakewalk, either. The firm, founded in San Jose in 1984 with an initial investment of $1 million, shot straight to the top of the "cleaner" energy production heap, primarily by building and acquiring natural gas-fired power plants. In four short years, that million bucks turned into assets of $21 billion. Its 1996 IPO was the largest offering ever for an indie energy firm. By the year 2000, Calpine had 58 facilities pumping out 3,355 megawatts, enough juice to light up San Francisco, San Jose, Oakland and Sacramento, with java to spare.

The good times stopped dead with the California energy crisis of 2001, a downturn in the economy and the collapse of Enron. Still, by 2004, Calpine had soared to an 89 energy-plant portfolio, generating some 22,000 megawatts of electricity. But the writing was on the wall. Calpine stock, which traded for more than $50 a share in 2001, nose-dived to just over two bits (as in pennies) a share in 2005. It was time to fold the ole traders' tent. On Dec. 20, 2005, Calpine sought Chapter 11 bankruptcy protection under the guidance and expertise of its new CEO, Robert P. May.

Get it straight, buster—I'm not here to say please, I'm here to tell you what to do, and if self-preservation is an instinct you possess, you'd better fucking do it and do it quick! I'm here to help. If my help's not appreciated, then lots of luck, gentleman.

—Winston Wolfe in Pulp Fiction

Just a week and a day before filing its bankruptcy, the financially distraught Calpine named May its CEO. Energy deregulation, thanks to verminish members of Dick Cheney's power-bud junta, had wrecked Calpine, just as they had wrecked both PG&E and California's aptly-named pre-Governator Gray Davis. The state economy still listed from a mega-profitable surge (for some) of blackouts, brownouts, cutbacks and hyperaccelerated price hikes that financially haunt us to this very day.

May stepped in and worked his well-honed magic. Calpine reorganized, emerging from bankruptcy just this past January. Shortly afterward, with Calpine hosed down and ready to rock again, May announced he'd depart Calpine by year's end.

In the meanwhile he'll be advising Deutsche Bank about flat-earth investments, and John McCain about how to best serve corporatist interests, should the old fellow manage to find the keys to the White House. Under "Board Members Affiliated" with Robert May, BusinessWeek lists 121 such connections. These include, but are not limited to Procter & Gamble, U.S. Airways, Daimler, General Motors, Bayer, JPMorgan Chase, BASF and Hyundai.

Great & Powerful Oz

So an individual CEO, let's say, may really care about the environment. In fact, since they have such extraordinary resources they can even devote some of their resources to that without violating their responsibility to be totally inhuman.

—Noam Chomsky

Oh, no, my dear, I . . . I'm a very good man—I'm just a very bad wizard.

—The Wizard of Oz

If David Leuschen and Robert May are capitalist archetypes, with Leuschen a Mr. Money Bags, initiating practices and funding projects that May, the Cleanup Guy, is invariably obliged to set right, then our third Geyser-guy, one Kenneth T. Derr, sits Humpty-Dump atop them both. Derr embodies just about everything a genuine corporate fat cat could ever hope to be. He's the Wizard of Oz, CEO of Emerald City, that sparkling green place comprised of stone-precious folding green, and maybe even a skosh of environmental green, too—assuming it translates into more mounds of moolah.

Derr is the oldest and most prominently connected member of this troika of well-connected execs. Derr was named to Calpine's board in 2001. He served as Calpine's interim CEO until Bob May came aboard to guide them through bankruptcy.

Calpine founder Peter Cartwright got shit-canned in the wake of Cheney's energy-industry imbroglio-cum-Enron debacle. The chairmanship of Calpine's board was then, fittingly, handed over to the old oil dude, Derr. Derr resigned from the Calpine board late this last spring, his exit curiously coinciding with NRG's hostile Calpine takeover bid.

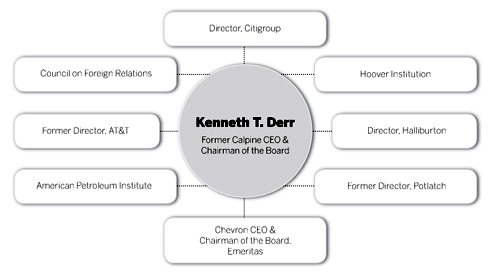

But Calpine, once the nation's largest independent, and one of the nation's cleanest electricity providers, had to be small potatoes to Ken Derr. Consider that for 10 years, from 1989 to 1999, Derr was both CEO and chairman of the board at Chevron Corp.

But that's just for starters. Derr's a former board member at both AT&T and Potlatch Corp., is a member of the right-wing Hoover Institution's Board of Overseers, a former chair of the American Petroleum Institute, sits on the Council on Foreign Relations, the National Petroleum Council, the Business Roundtable, the Basic Fund, the California Business Roundtable, belongs to the exclusive Pacific Union Club, the equally exclusive San Francisco Golf Club, the UCSF Foundation and the Orinda Country Club.

Derr's pillaging for pachyderms include jaunts benefiting the George W. Bush for President Committee, Bush-Cheney 'O4, the Friends of Giuliani Exploratory Committee, the Rudy Giuliani Presidential Committee and, when those last two lost traction, Derr sidled up to John McCain.

Derr's Chevron tenure was marked by grand success and not a few dark controversies. "Better than the best" was Derr's motto. Some tagged him a "philosopher king." Others called him a polluter and human-rights violator.

With Ken Derr at the helm, Chevron shifted emphasis from domestic to foreign petrol acquisitions, selling off two-thirds of its domestic gas and oil holdings. By shifting primary oil acquisitions from domestic to international fields, Chevron skirted EPA restrictions that otherwise would have cut into profits. He instituted a hard-driving informality into Chevron's button-down corporate culture, carved up sheeps' heads to get at oil in Kazakhstan, and pulled focus on Kuwait's Burgan Field, the second largest oil repository in the entire world.

Destiny Road

Back where I come from there are men who do nothing all day but good deeds. They are called phila . . . er, phila . . . er, yes, er—Good Deed Doers!

—The Wizard of Oz

Ken Derr is known for his philanthropic efforts. He co-chairs the Committee to Encourage Corporate Philanthropy and has even shared the stage with renowned bleeding heart Paul Newman. Perhaps someday we'll see Derr holding hands with Bono. But before getting all misty-eyed and blubbery, consider Derr's May 28, 1998, exchange at the annual Chevron stockholders' meeting with Democracy Now! host Amy Goodman. Goodman inquired whether Derr would ask the Nigerian dictator to halt Chevron-abetted murders of anti-Chevron protesters. Derr's response? A curt "No."

But recent news tied to Iraq War #2 show how another Kenneth Derr quote still resonates with the U.S. corporate state. Addressing San Francisco's Commonwealth Club on Nov. 5, 1988, Derr famously said, "Iraq possesses huge reserves of oil and gas—reserves I'd love Chevron to have access to." It took 20 years to accomplish, but, judging from recent Iraqi government pronouncements, who can deny corporate inertia über alles?

Before leaving Derr, perhaps we should touch on two board memberships he currently holds. First there's Citigroup, named by Forbes as the world's largest company. Citigroup has a market value of a quarter of a trillion dollars. It tallied almost $22 billion in net profits on revenues of $147 billion last year, and its assets clock in at close to $2 trillion.

And finally there's this little Dubai-based company called Halliburton. Derr sits on that board of directors, too. Much could be hammered into this, but with Halliburton being such a wide-body target, it feels rather unsportsmanlike to do so.

So, yes, even obscure, innocuous and fairly clean energy resources like The Geysers tend to be controlled by the very corporatists whose greedy, polluting ways necessitated we stage a green revolution in the first place. And by continuing to destroy life on this planet, these folk actually enhance the eventual worth of their heretofore minor or even purposely suppressed alternative-energy investments.

Pessimism aside, the question remains whether we should continue placing both our common resources (tax monies) as well as our personal resources into the hands of corporate-energy providers.

Which leads us finally here, to that next grand fork down Destiny Road.

"Now which way do we go?"

"Pardon me, this way is a very nice way."

"Who said that?"

(dog barks)

"Don't be silly, Toto. Scarecrows don't talk."

"It's pleasant down that way, too."

"That's funny. Wasn't he pointing the other way?"

"Of course" (Scarecrow extends both arms) , "some people do go both ways."

Send a letter to the editor about this story.

|

|

|

|

|

|